By Akiko Inoguchi

Transformational change of forest product value chains

FAST READ

-

Transformational change in forest product value chains in the Lower Mekong Region implies a shift in forest product value chains from systems that support deforestation and forest degradation, illegal logging and trade to systems that support the sustainable management of the region's forests and legal and sustainable forest product value chains which benefit all stakeholders.

-

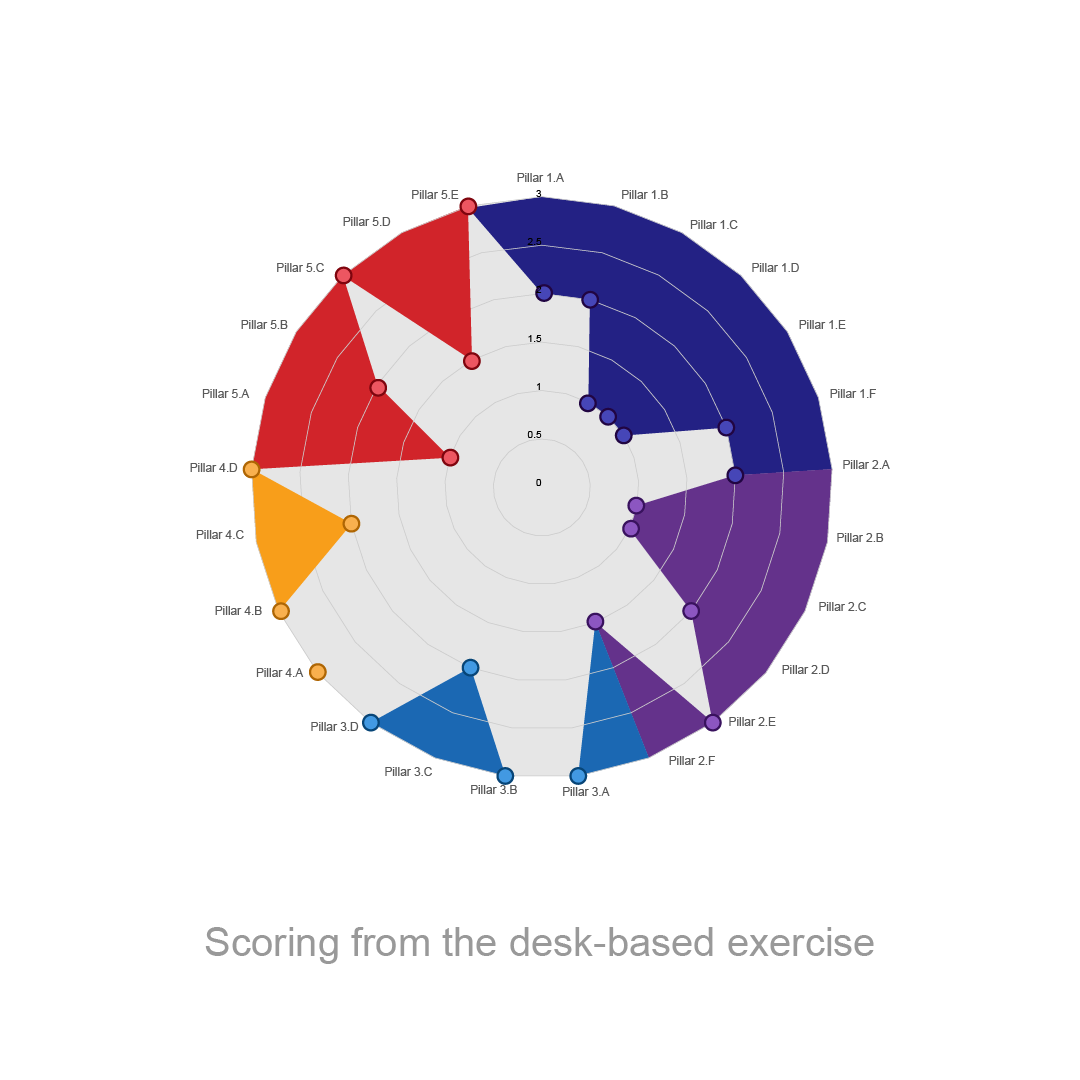

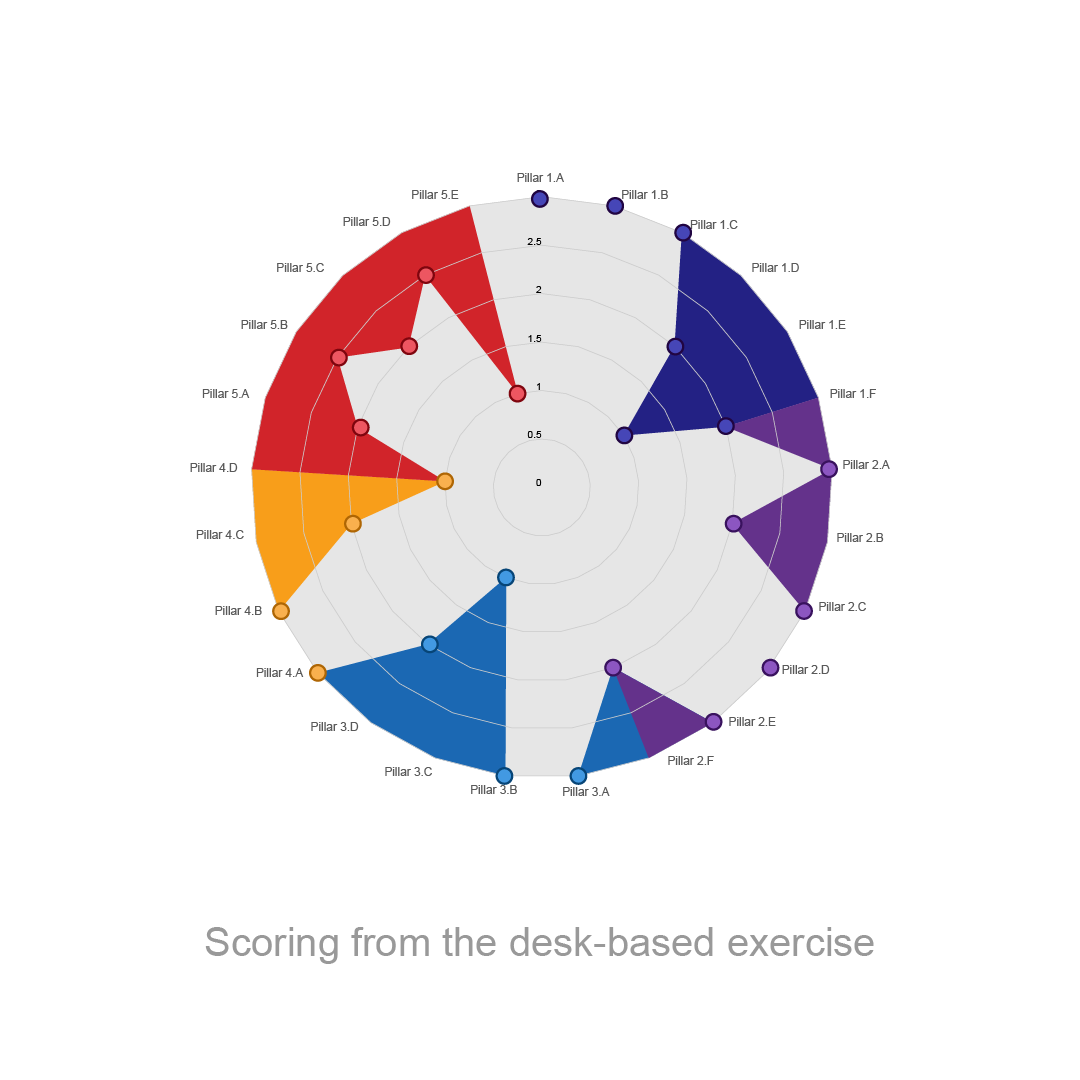

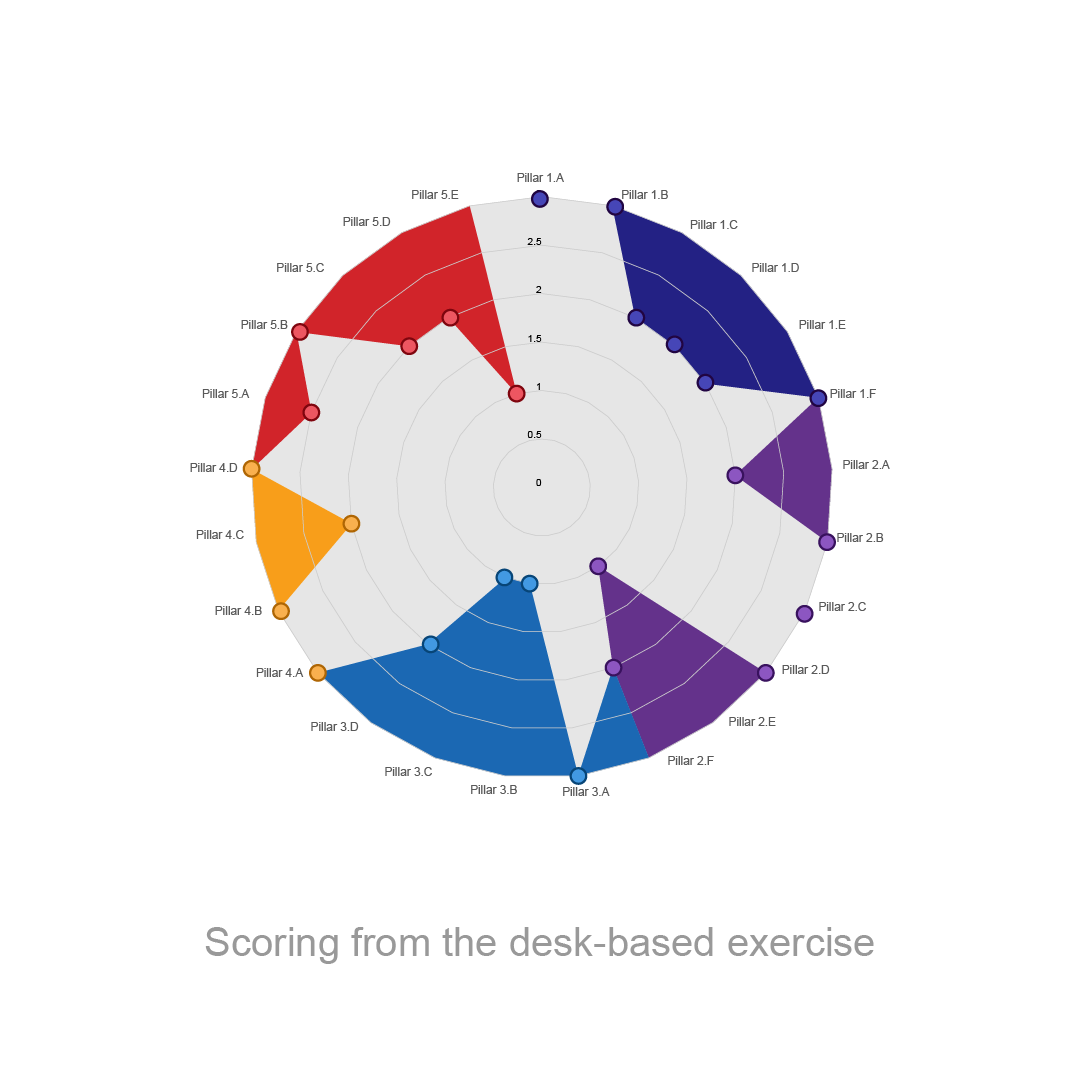

Here we examine the pillars needed to trigger transformational change from deforestation to sustainable and legal supply chains, considering where LMR countries are placed in the trajectory to transformation change and priority needs. A desk-based country scoring exercise against indicators of sustainability was conducted to inform this discussion.

-

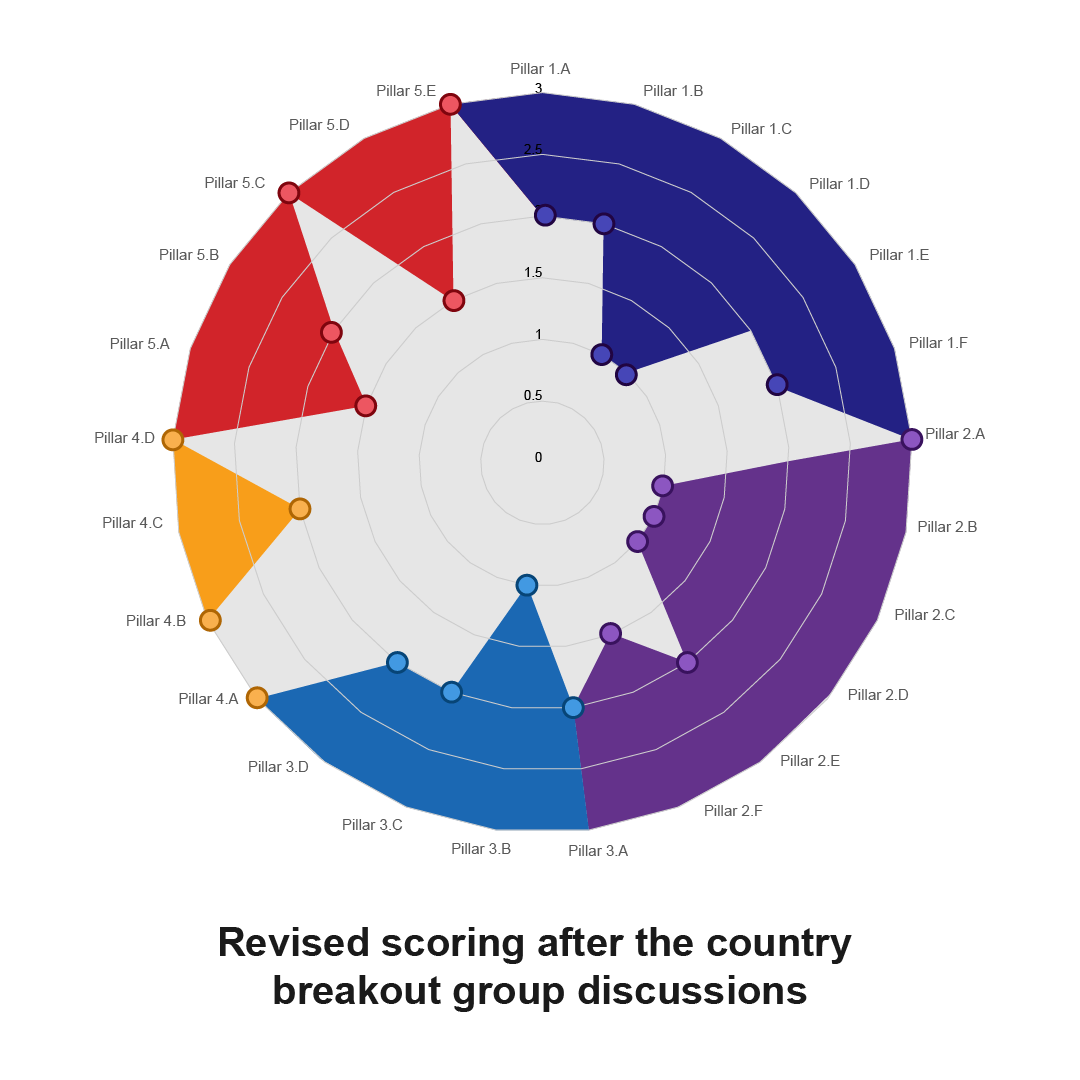

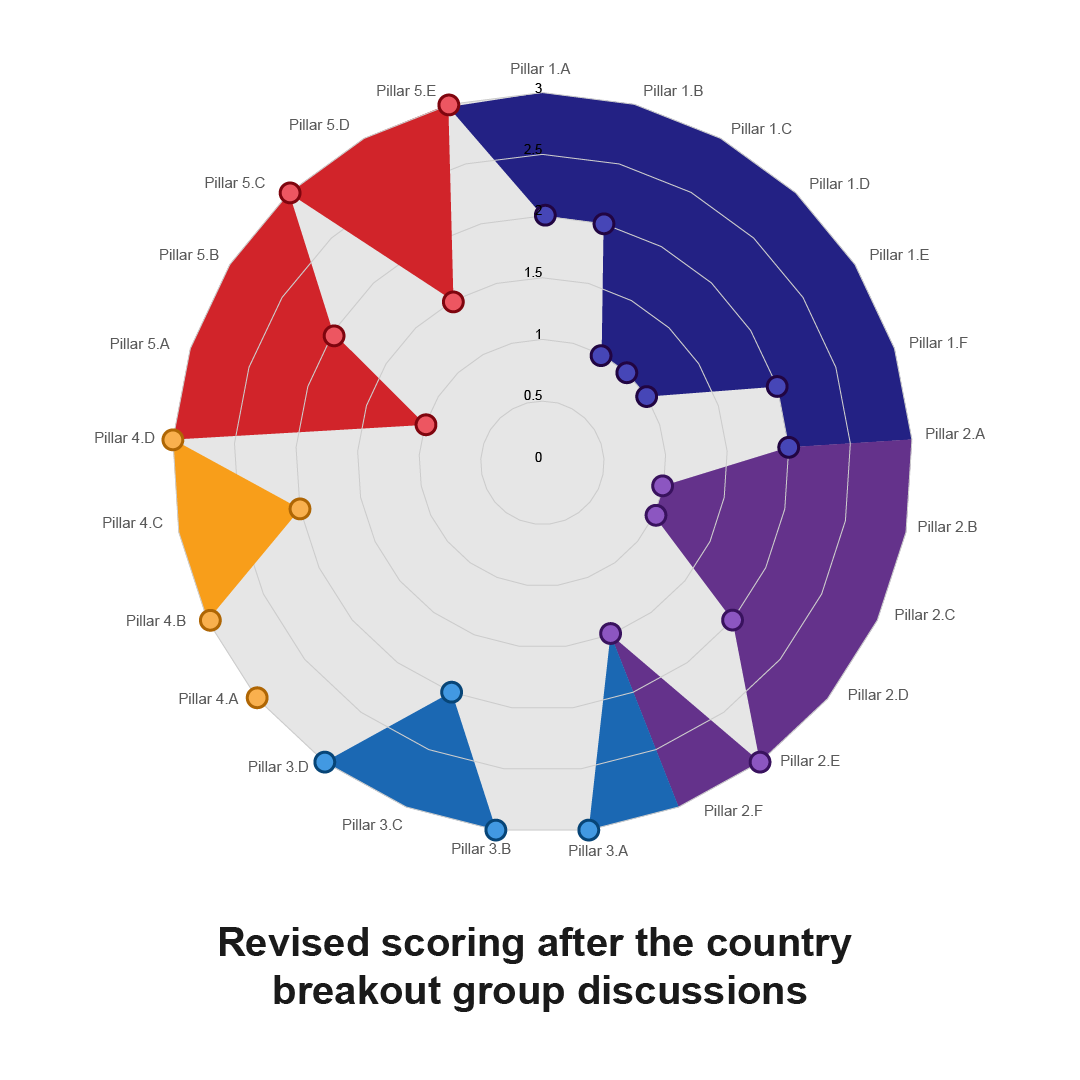

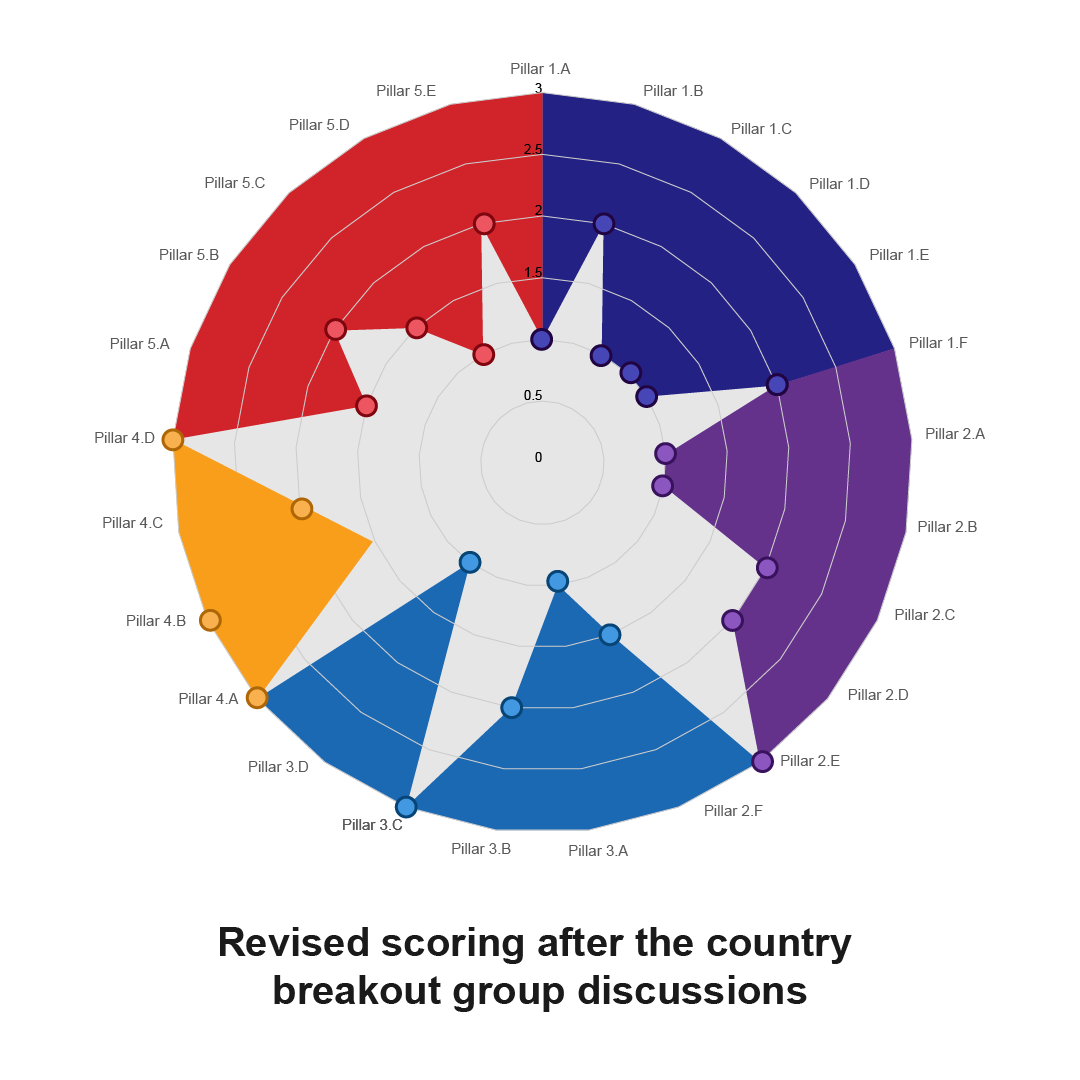

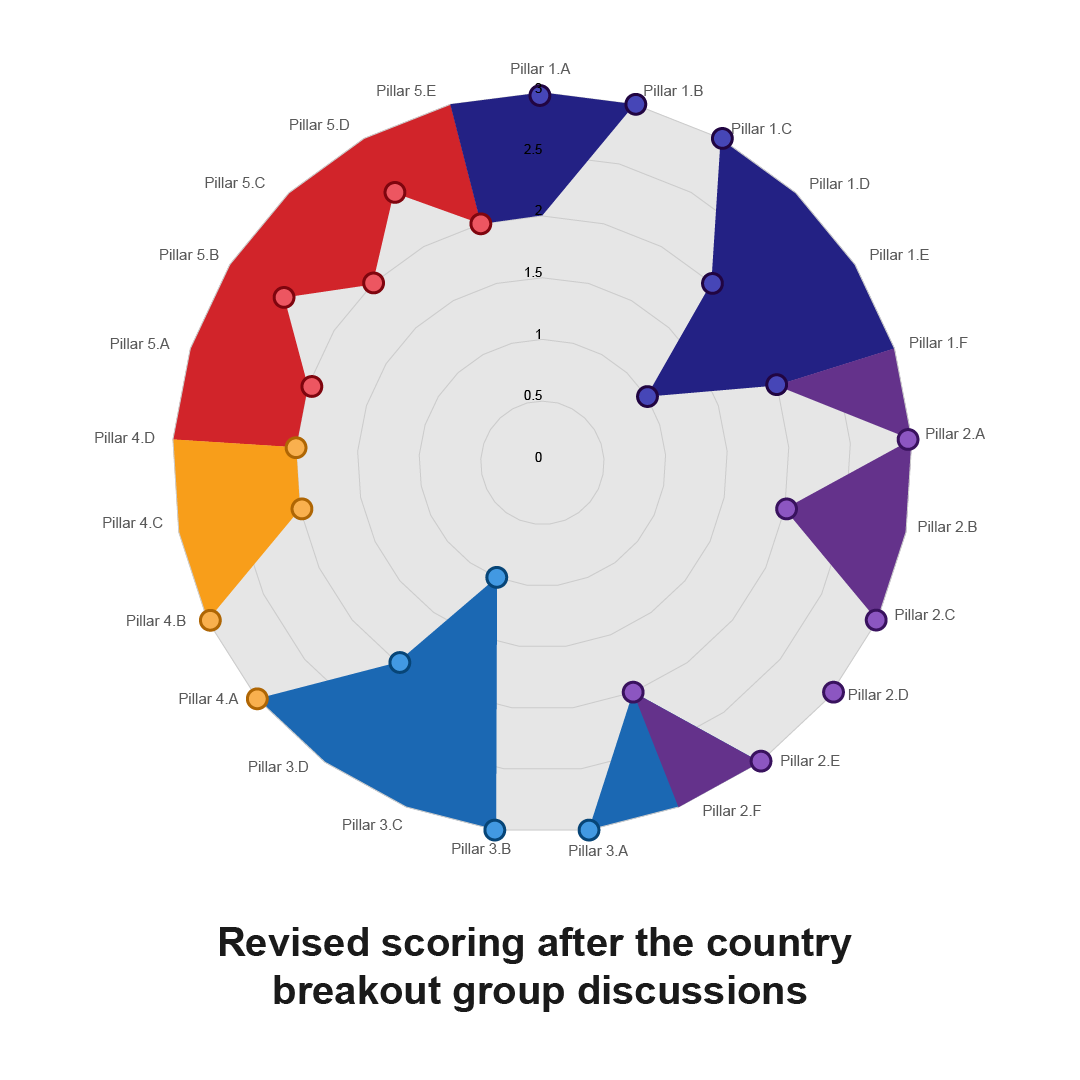

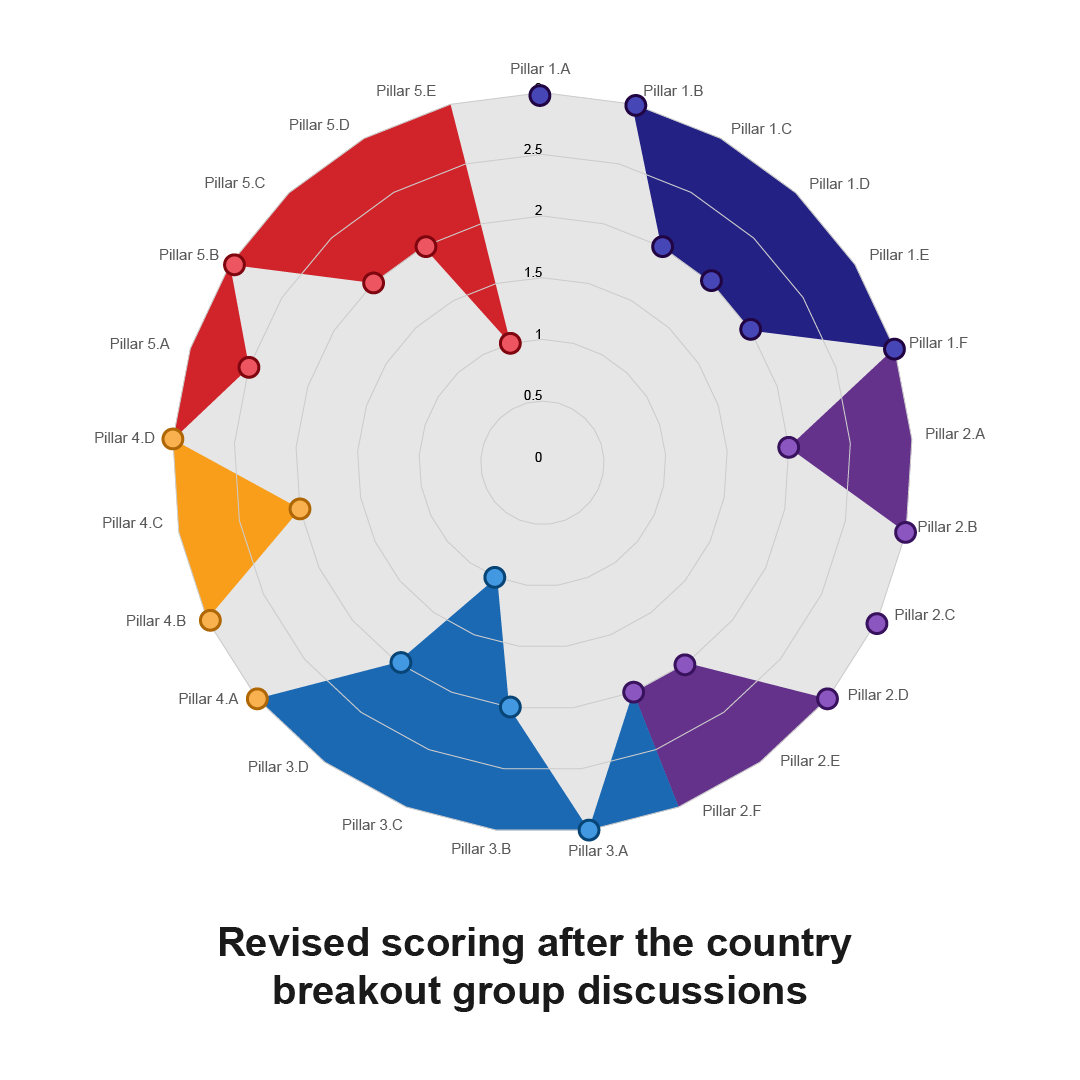

During the 2022 Regional Dialogue, country break-out groups were asked to review the scoring and provide inputs to the questions: How do country stakeholders view the scoring? What are their current priority areas of work? What would be their vision for 2035?

FOOTNOTE 1: Based on a study conducted by FAO and ITTO (coming soon).

What is transformational change for forest value chains in the Lower Mekong?

In 2022, the Food and Agriculture Organisation of the UN (FAO) FAO and the International Tropical Timber Organization (ITTO) under the UN-REDD Lower Mekong Initiative explored the notion of transformational change in the forest product value chain in the Lower Mekong Region.

Transformational change is defined as “a shift in forest product value chains from systems that support deforestation and forest degradation, illegal logging and trade, to systems that support the sustainable management of LMR forests and legal and sustainable forest product value chains which benefit all stakeholders.” (FAO-ITTO, Transformational Change Report. To be published.)

The FAO-ITTO report takes a deep dive exploring the dynamics of forest products trade as well as how forest industry and markets have developed in each of the five LMR countries since around 2010 identifying that:

-

Wood products trade has undergone significant changes over the last decade, the most dramatic being a plunge in exports of primary wood products from natural forests due to resource depletion, harvesting and trade restrictions, marginal economic returns from commercial forests, and changing consumption levels in consumer markets;

-

There has been a corresponding increase in production and trade from plantations, particularly from Viet Nam and Thailand. The region’s wood processing demand has also been supplied by imports or primary products from other “high-risk” regions such as Africa and the Pacific);

-

In the last decade, exports of primary products from the lower Mekong region are overwhelming to China;

-

More highly processed wood product exports are mainly to extra-regional destinations – the United States, EU and Japan – with high requirements for legality and sustainability.

(Source: FAO-ITTO, Transformational Change Report. To be published.)

Pathway to transformational change of the forest products value chains

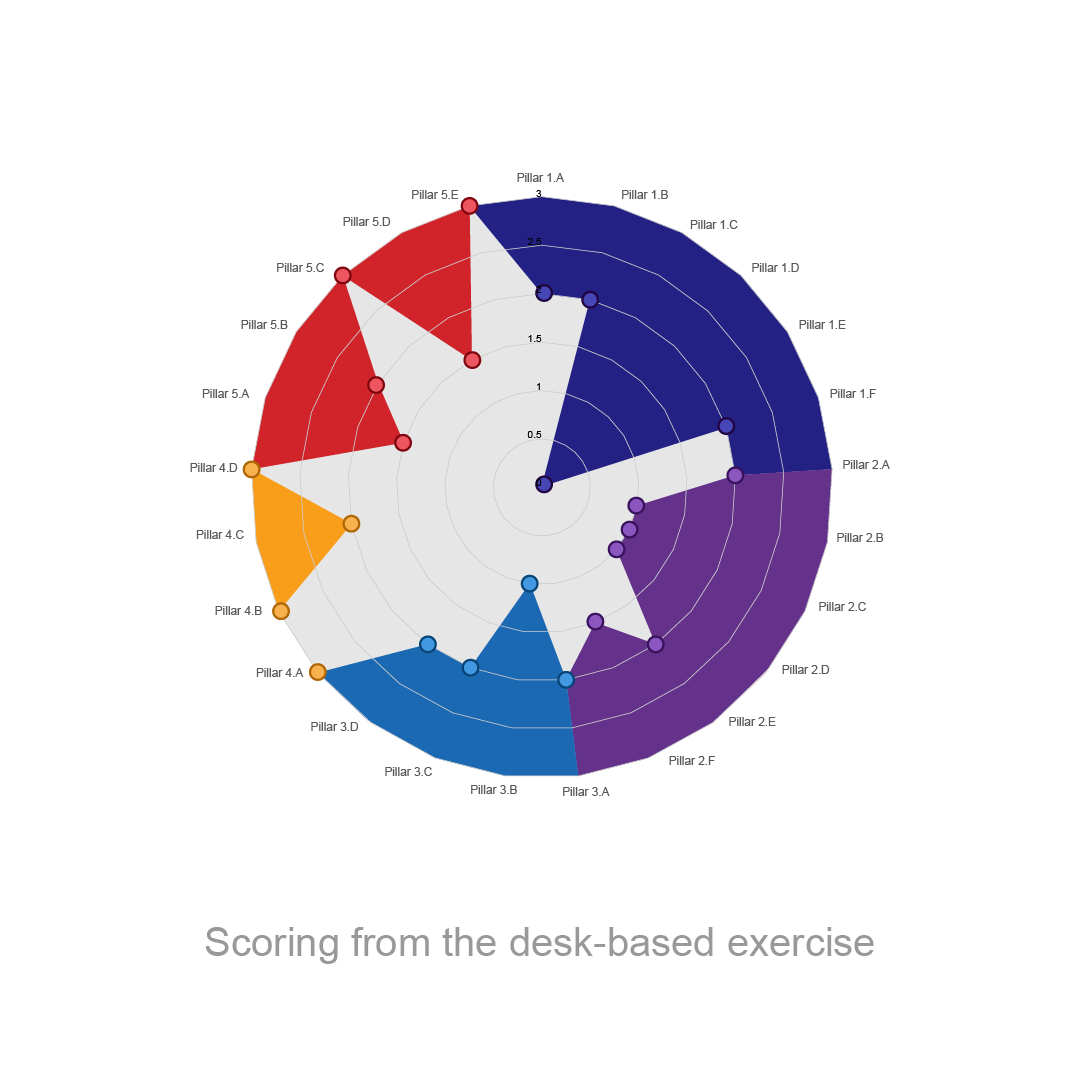

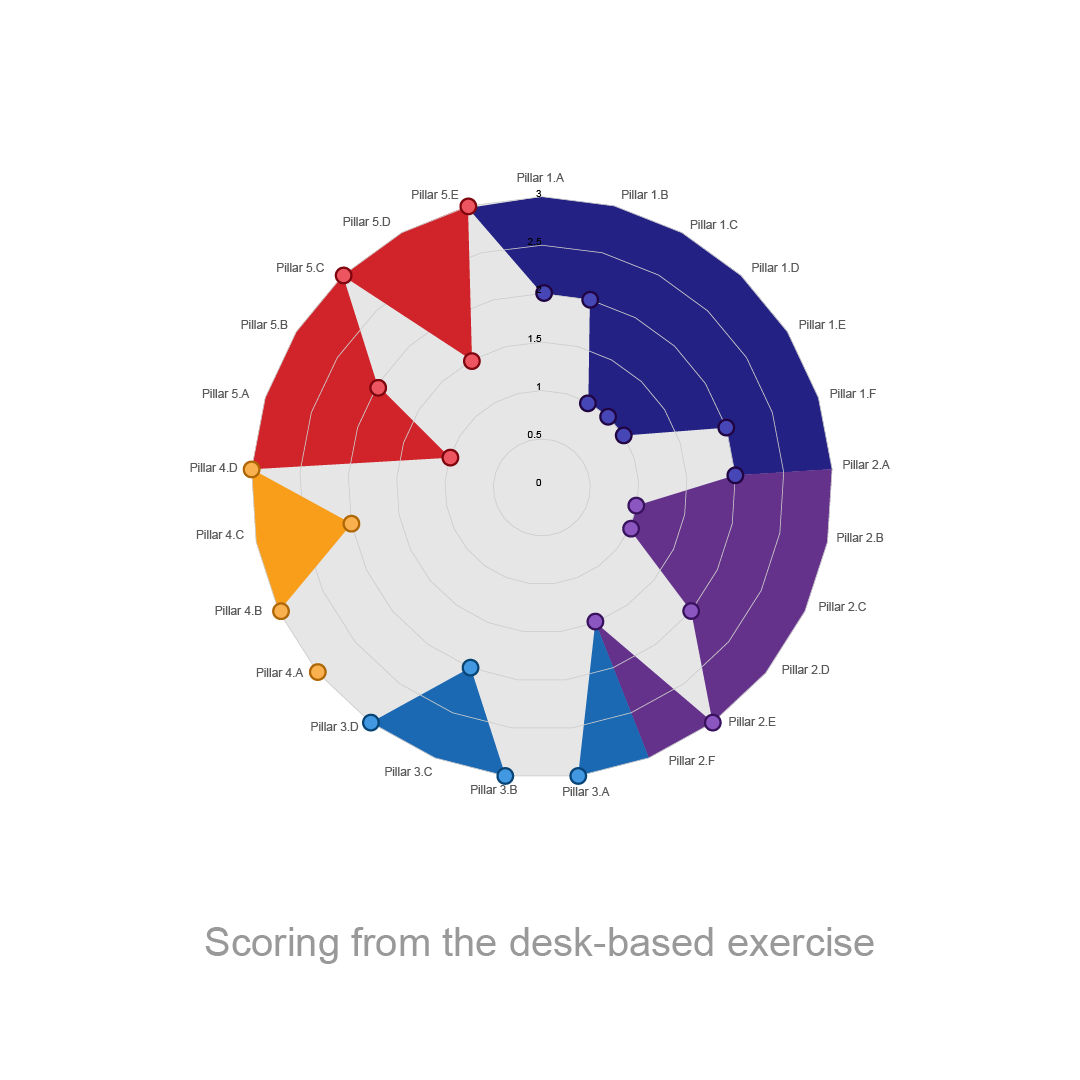

The UN-REDD Lower Mekong Initiative used data from the FAO-ITTO report to identify five pillars that support the transformational change of the forest products value chains - identifying a set of criteria and indicators for each, to assess where the five countries are with a view of transformational change.

During the Regional Meeting 2022, this was followed by an exercise inviting country breakout group participants to review the assessment report-based scoring per country. Importantly, the scoring and assessment exercise is intended as a key step in understanding the countries’ current standing, in order to better strategize where we go next – and is NOT meant as a report card of sorts. In this regard, we draw your attention to the outer area of the country spider diagrams below (coloured area), indicating the scope towards potential change and improvements.

The five pillars of transformational change in forest products value chains are:

- Competitiveness – Trade growth, product quality, resilience to shocks

- Market access & compliance – How forest product value chains comply with the ‘rules of the game’

- Forest viability – Deforestation rates, productivity of forests, forest integrity

- Social and environmental safeguards – Participation in forestry, safeguard tools, gender, forest valuation

- KAP - Knowledge, attitude and practices of the general public on forest products consumerism

Pillar 1: Competitiveness - Trade growth, product quality, resilience to shocks

Data source: FAO-ITTO Transformational Change Report

Scores in the table indicate desk-based scores, with scores colored where revisions were made through the country breakout groups. Revised scores by country breakout groups are indicated under the tables

Pillar 1 revised scores by country breakout groups

Cambodia

Product Quality

1: known to be low quality

Capacity of MSMEs

1:

COVID Impacts

2: impacts are equivalent to global level

Thailand

Trade Growth

2: as trade growth was disrupted by COVID-19 impact. Although rebound in 2021 but will need to review 2022 to see consistent growth

Product Quality

n.b. Noting that this is for rubber products - not for furniture and processed products

Pillar 2: Market access - compliance - How Forest product value chains comply with the ‘rules of the game’

Data sources: FAO-ITTO Transformational Change Report

Scores in the table indicate desk-based scores, with scores colored where revisions were made through the country breakout groups. Revised scores by country breakout groups are indicated under the tables

Pillar 2 revised scores by country breakout groups

Cambodia

Trade Sanctions

3: There are no sanctions in place.

Myanmar

Sources of Timber

1.5: Currently dependent mostly on natural species – particularly endangered sp while policies on plantations are not yet clear

Viet Nam

Sources of Timber

2: Domestic source of raw wood has met 80% of the demand (according to the statistics of MARD).

Pillar 3: Forest viability - Deforestation rates, productivity of forests, forest integrity

Data sources: FAO, ITTO, FLII, UNFCCC (country data)

Scores in the table indicate desk-based scores, with scores colored where revisions were made through the country breakout groups. Revised scores by country breakout groups are indicated under the tables

Pillar 3 revised scores by country breakout groups

Myanmar

Restoration Potential

Confused. Does this just mean that Myanmar still has plenty of areas for restoration?

Viet nam

Sustainable Production

2: Output for FSC certified timber seems to have met the demand for exports.

Pillar 4: Social and environmental safeguards - Participation in forestry, safeguard tools, gender, forest valuation

Data sources: National submissions to UNFCCC, national policy documents, REDD+ Opportunities Assessment Tool (ROAT)

Scores in the table indicate desk-based scores, with scores colored where revisions were made through the country breakout groups. Revised scores by country breakout groups are indicated under the tables

Pillar 4 revised scores by country breakout groups

Myanmar

Safeguards Instruments: FPIC, GRM,Benefit Sharing

2: Systems are in place as documents, but not functioning or fully implemented.

Thailand

REDD+, VCS readiness

1: Although Warsaw Framework not complete, have developed REDD+ strategy; SIS framework is under review. SOI has been prepared and will be included in next BUR. Synergies exist between NFMS and NDC. Now looking for opportunities to submit proposals on climate finance.

Pillar 5: KAP - Knowledge, Attitude and Practices of the general public on forest products consumerism

Data source: Knowledge, Attitude, Practices Survey

Scores in the table indicate desk-based scores, with scores colored where revisions were made through the country breakout groups. Revised scores by country breakout groups are indicated under the tables

Pillar 5 revised scores by country breakout groups

Myanmar

KAP Index

As the scope of survey has limited in some areas, interpretation should/could not reflected the national level

Thailand

Care About Stopping Illegal Logging and Illegal Forest Trade

2.5: more about lacking knowledge and accessibility

Social Norms

2: certification is being more sought after and increasing demand for responsible sourcing, with time.

Unpacking transformational change

Systems that support sustainable management of forests, legal and sustainable forest products value chains which benefit all stakeholders

Scoring of transformational change of the forest products value chains

Cambodia

Lao PDR

Myanmar

Thailand

Viet Nam

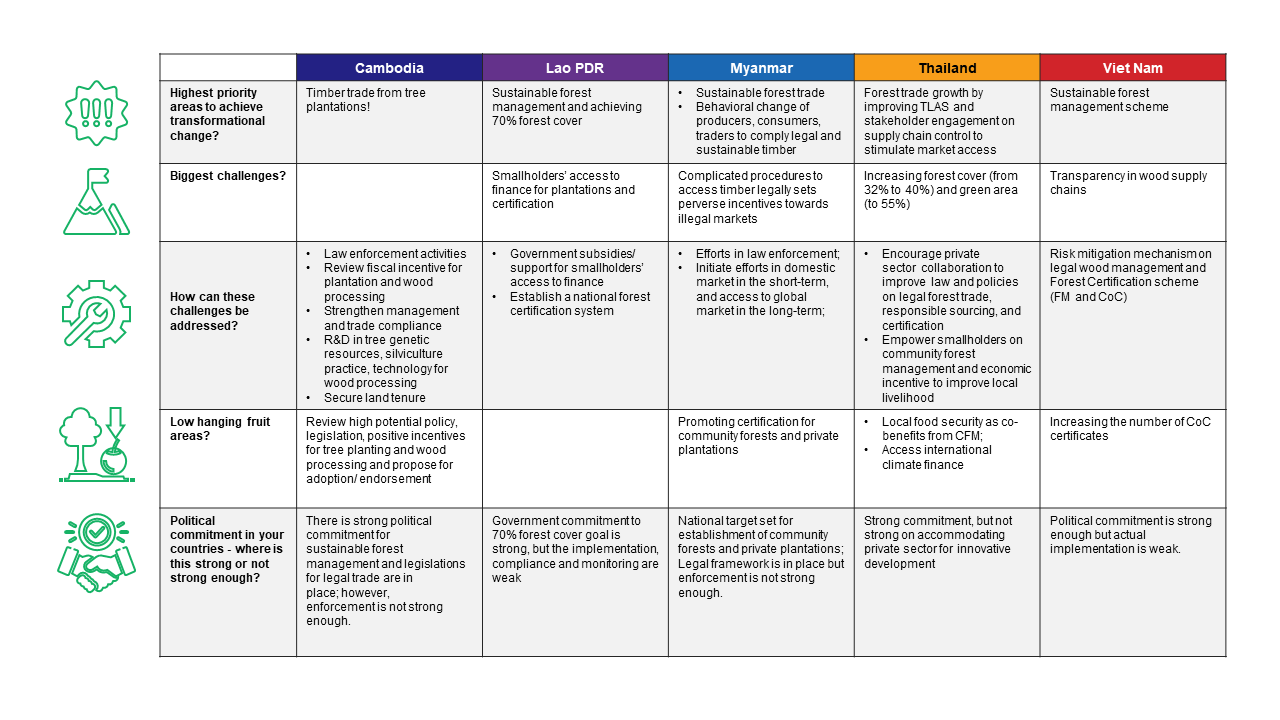

What are the priorities to transformational change, and how can you get there?

The country breakout groups were then tasked to identify:

1. Priorities for transformational change

2. The key challenges and barriers in the way

3. Any low-hanging fruit to take advantage of?

4. What is the political commitment and willingness in each country.

Priority setting for transformational change

Thinking towards the future

Country breakout groups were asked to make a statement forecasting the positive changes in the forest products value chains that could be achieved in ten plus years from now.

“The year is 2035 …”