…‘Need more knowledge on safeguards and financing’…

…’More support on safeguards information systems and accessing finance for transition into investment planning and implementation’…

…‘Strengthen the support for the safeguards information system and the investment plan’…

These are some of the comments made by the African community of practitioners attending the Regional UN-REDD South-South Knowledge Exchange on ‘Navigating the Transition from REDD+ Readiness to Implementation’ held in September 2017. Safeguards and financing were repeatedly mentioned in the same breath, with REDD+ focal points and technicians from across the region identifying ‘the safeguards-financing nexus’ as a priority for future South-South cooperation. This dialogue took place in Nairobi, one week before the Green Climate Fund’s (GCF) 18th Board Meeting in Cairo, where a pilot programme for REDD+ results-based payments was on the agenda…

But this safeguards-for-financing need lies across all three phases of REDD+: from readiness to implementation, as well as payments for results.

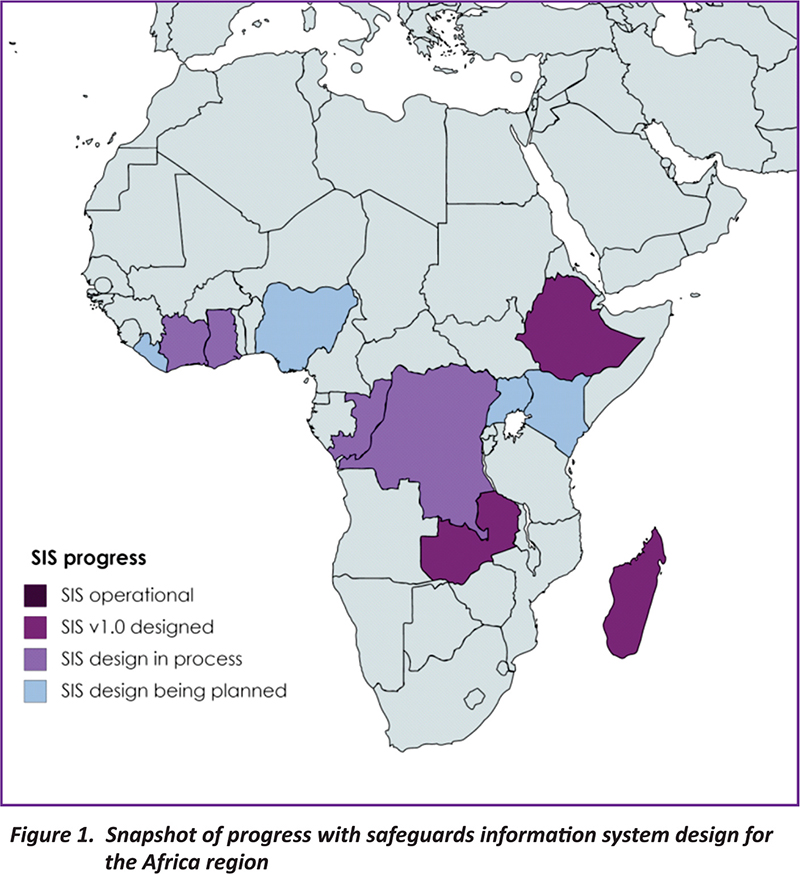

Despite making progress on three of the four pillars of the Warsaw Framework for REDD+, no country in Africa has yet to meet the fourth pillar of safeguards requirements under the United Nations Framework Convention on Climate Change (UNFCCC). The tangible outputs of this pillar are twofold: a national-level safeguards information system; and periodic submission of summaries of information to the Convention. About one third of the countries participating in the Nairobi event have a first draft outline of a safeguards information system; one third are at some point in a process to design such a system; and the remaining third are just starting to plan for such a design process (see Figure 1).

No country in the region has an operational safeguards information system, and no African country has made a start on the second deliverable – a summary of safeguards information.

While there is much to do on the safeguards front in the Africa region, after nearly a decade of readiness-phase financing, the money to support the completion of this lagging Warsaw pillar has largely been spent and countries might find themselves left high and dry without the necessary financial and technical assistance to finish the job.

Moving into the second phase of REDD+, some African countries are starting to draft investment plans to secure the financing needed to operationalise national REDD+ strategies and pay for the REDD+ actions that have the potential to yield carbon results. There are two safeguards-finance challenges here. The first is about having a robust safeguard framework and information system design as the basis for pricing capital outlay and recurrent operational costs to run this safeguards machinery. The initial indication from Africa and other regions is that these costs are not high: half to two percent of total investment costs during the first five years of implementing REDD+.

Second is the fact that each investor will apply their own corporate safeguards, or industry best practice standards, to the REDD+ actions that they are financing. These could be multi-lateral development banks (such as the World Bank and its Operational Polices), commercial banks (applying International Finance Corporation Performance Standards), or private businesses (applying sector-specific certification standards). Every investment going into the landscape will need to adhere to financers’ safeguards, while fitting into the overarching national framework and information system put in place to meet UNFCCC requirements.

When it comes to phase three of REDD+ – payments for carbon results – multiple safeguards requirements are, once again, a major challenge. Within the region, two sources of results-based payments have come into play at sub-national scales: jurisdictional programmes financed by the Forest Carbon Partnership Facility or BioCarbon Fund (using World Bank safeguards); and voluntary carbon market projects (applying voluntary best practice standards, notably those of the Climate, Community and Biodiversity Alliance). Meeting safeguards requirements and information flows at these two scales will need to be reconciled with those of the national level.

Into this maelstrom of safeguards complexity and confusion comes a pilot programme for REDD+ results-based payments, which was just approved by the GCF. The new programme will channel USD 500 million to countries that meet all UNFCCC requirements; a safeguards information system and submission of a summary of information being basic pass/fail eligibility criteria. But, as with all other financing passing out through the GCF’s door, the fund’s own safeguards will also need to be applied to phase three of REDD+.

African countries looking to access these payments, as well as financing for the first two phases of REDD+, need to up their safeguards game urgently. Further technical assistance, from international development partners, is needed if Africa is not to be left behind as countries elsewhere move into full implementation, start claiming payments for results and draw down the finite financing available for REDD+.

For more information on fulfilling REDD+ safeguards requirements under the UNFCCC:

- UN-REDD workspace Safeguards Country Resources Hub

- UN-REDD Technical Brief 1 v2.0: REDD+ Safeguards Information Systems: practical design considerations (English / Français / Español)

- UN-REDD Info Brief 5 - Summaries of information: How to demonstrate REDD+ safeguards are being addressed and respected (English / Français / Español)