STEP 1: ANALYZE

Chapter 2 - What are the trends in consumer demand for timber?

Note: This chapter looks at consumer demand for hardwood furniture using survey data on actual and planned purchasing behaviour, and consumer awareness and understanding of the concept of responsible purchasing.

KEY MESSAGES

Chinese consumers reported plans to purchase more hardwood furniture in the future, indicating that the demand is still growing. Thailand and Vietnam have lower levels of demand compared to China, but survey data points to the possibility that they will become significant hardwood consumers in the future.

There is a disconnect between consumer knowledge and concern with forest crime. Over 80 percent of Chinese respondents were familiar with the concept of “responsible purchasing” (compared with 20 to 40 percent in the Lower Mekong countries). Yet the survey found that Chinese consumers will still buy illegal wood if it is presented to them in retail stores, while consumers in Thailand and Vietnam will be more likely to act based on their knowledge of responsible purchasing.

While Rosewood and Teak remain the most popular hardwood species, other hardwoods such as Mahogany and Oak are important species being used for furniture production in Lower Mekong countries. This indicates that when the most popular hardwood species become over-harvested and difficult to find, alternative hardwood species such as Mahogany and Oak could become more widely exploited in the Lower Mekong region.

To some extent, the survey found that consumers in China, Thailand and Vietnam hold the perspective that stopping illegal logging is not an issue they are responsible for. Government and industry are seen as holding greater responsibility than consumers in preventing illegal logging.

PURCHASING BEHAVIOUR

of respondents in China reported purchasing hardwood furniture in the past two years

of respondents in China purchase hardwood furniture which is also similar to 6 other target countries.

were the mostly likely to purchase hardwood furniture in China, Vietnam and Thailand.

in China and Thailand. 88% male versus 64% female in China, and 21% male versus 10% female in Thailand.

2.1. Chinese consumers are the leading purchasers of hardwood furniture

Consumers in China are the major purchasers of hardwood furniture among the six countries studied.

In China, 76 percent of respondents reported purchasing hardwood furniture in the past two years The respondents in the other three Lower Mekong region countries reported negligible levels of hardwood furniture purchases over the past two years: Cambodia at seven percent, Myanmar at five percent and Lao PDR at two percent. Because of this, the bulk of the analysis on purchasing behaviour in this Chapter focuses on China, Thailand and Vietnam.

2.2. Demand for hardwood furniture is growing

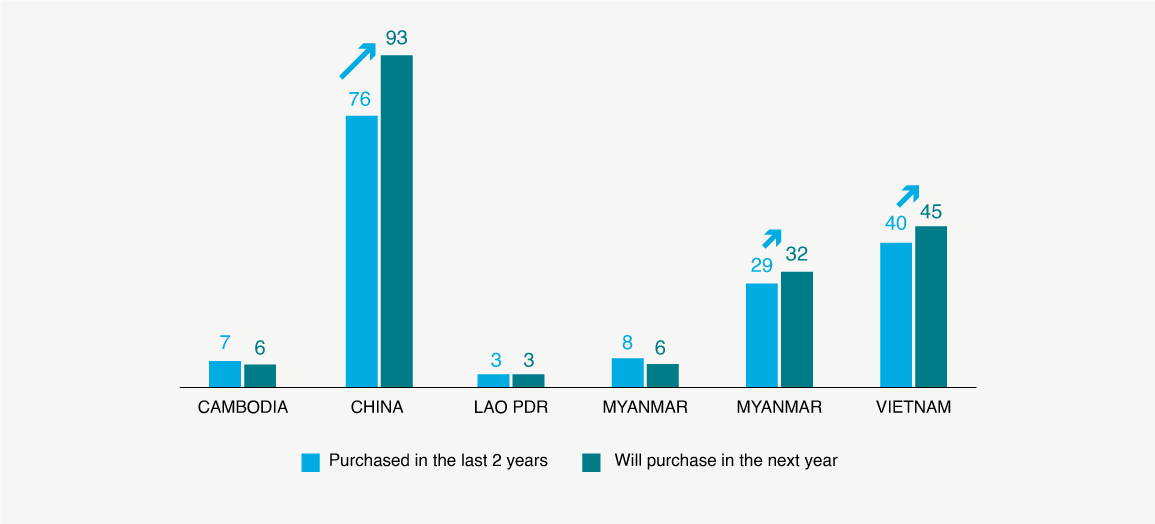

The demand trend for hardwood furniture was estimated by comparing the percentage of respondents who purchased hardwood furniture in the past two years with the percentage who plan to make purchases in the next year.

The survey points to a growing demand trend in China, as well as in Thailand and Vietnam but to a lesser degree. In China the survey found a 17 percent growth in demand for hardwood furniture.

Vietnam and Thailand had five percent and three percent growth in demand respectively. Stable but low demand was found in Cambodia, Lao PDR and Myanmar.

Vietnam and Thailand had five percent and three percent growth in demand respectively. Stable but low demand was found in Cambodia, Lao PDR and Myanmar.

2.3. Gender can influence purchasing behaviour in some countries

Zooming in on the extent to which demographic characteristics are relevant to purchasing behaviour, the study found that gender is a factor which differs by country. Age did not seem to be a particularly significant factor related to purchasing behaviour, although people in the 30 to 39 age group were the mostly likely to purchase hardwood furniture in China, Vietnam and Thailand. This is likely due to the fact that people in this age group are at the peak of their career and can afford to purchase hardwood furniture, and are in the stage of life when they need to set-up new family households.

2.4. Furniture stores are the main suppliers of hardwood furniture, but e-commerce is taking an increasing market share

The places where people purchase hardwood furniture were similar across the six target countries, but there were some notable differences. In China, the majority of respondents identified traditional furniture stores (67 percent) and modern furniture stores such as in shopping malls (64 percent) as the top places they have purchased hardwood furniture. Similar purchasing patterns were found in Vietnam and Thailand. The survey found that internet purchases of hardwood furniture were small but notable. As the market share of e-commerce businesses continues to grow globally (Ethical Trading Initiative 2022), this is an area of hardwood sales to watch.

2.5. Rosewood, teak, mahogany and oak are the most popular species of hardwood furniture

The survey found that there are clear preferences among consumers for Rosewood and Teak as well as Mahogany and Oak.

There was some variation in hardwood preferences within China and the Lower Mekong countries. This is significant as it may point to specific species “next up” to become hyper-exploited for domestic and export markets.

As prices rise for certain hardwood species, it may be difficult for local people to resist the temptation of the monetary value.

Some people cannot resist the temptation of the value of Tau tree (Apitong) which is almost 20 million VND (900 USD) per cubic meter (m3).

-Male respondent, urban CHINA

2.6. Consumers list certification and avoiding illegal tree species among their top influencers when buying hardwood

In China and across the Lower Mekong countries, style and design and quality were reported as the main influencers on consumer’s decisions around purchasing hardwood furniture

Forest crime related influencers such as avoiding illegal tree species and certification were secondary influencers, alongside price.

Notably, the survey found that “recommendation” was not considered an important influencer of hardwood purchasing behaviour in any of the three countries.

2.7. Hardwood alternatives such as rubberwood and composite wood products are already popular among consumers

In addition to hardwood furniture, consumers in China, Vietnam and Thailand are buying furniture constructed from other species of wood and composite wood products.

As these hardwood alternatives are already popular with consumers, they are likely to be open to choosing alternatives to hardwoods more often in the future with the right incentives.

RESPONSIBLE PURCHASING

2.8. Responsible purchasing is well known among urban consumers and young people

In all countries, young people reported greater awareness of the concept of responsible purchasing. Urban residents reported greater awareness of the concept than rural residents, regardless of their age. This is good news as it indicates that in urban areas where there is higher demand for hardwood, there is also a greater awareness of responsible purchasing.

Over 80 percent of Chinese respondents were familiar with the concept of “responsible purchasing”.

Despite this knowledge and stated willingness to make responsible purchases (and a new Chinese law, Article 65, banning the import of illegal timber), the survey found that Chinese consumers will still buy illegal wood if it is presented to them in retail stores.

2.9. Gender did not appear to be a significant differentiator for awareness on ‘responsible purchasing’

Gender did not appear to be a significant differentiator for awareness of responsible purchasing in any target country, but there were some notable differences across countries (Figure 10). In Cambodia, China, Myanmar and Thailand, male respondents were more likely to be aware of the concept of responsible purchasing. In Lao PDR, female respondents were more likely to be aware of the concept. In Vietnam, women and men reported awareness at equal levels.

2.10. Consumers’ understanding of responsible purchasing is focused on supply chain factors

The survey found that in all countries people associate responsible purchasing with ‘certified or legal products,’ ‘not from protected trees’ and ‘zero deforestation’ at relatively high levels. This indicates that there is solid understanding of the concept of responsible purchasing as it relates to forests and wood products.

These findings show that the common understanding of the concept of responsible purchasing is focused more on the supply chain (logging and retail) rather than consumer demand.

2.11. Consumers see government enforcement and supply chain ethics as more important than consumer demand for the prevention of forest crime

In all countries, people feel that it is mainly the government and manufacturers who are the levers for making drastic changes in purchasing behaviour, and for ensuring that responsible purchasing happens, followed by retailers and lastly consumers

This finding is also significant as it signals that people in China and the Lower Mekong do not necessarily see the role of consumer demand for hardwood products as a driver of illegal logging and forest crime.

The study also found that respondents do not necessarily make a connection between their purchasing behaviour and the market actors supplying illegally harvested wood. If they do not place themselves in the picture when thinking about the overall supply chain for illegally harvested wood, they likely do not see the role that they can play in preventing forest crime

2.12. Consumers in china report practicing responsible purchasing of wood furniture, including of certified products

While majority of respondents in all countries reported practicing responsible purchasing in one or more specific consumer sectors over the past year, only people in China (77 percent), Vietnam (26 percent) and Thailand (23 percent) reported practicing responsible purchasing of wood furniture at significant levels.

This indicates that the very few consumers in Lao PDR, Cambodia and Myanmar that purchase certified products may have more to do with availability of such option than their willingness or understanding of the matter.

Conclusion

This chapter outlined the purchasing behaviours of urban consumers for hardwood furniture, highlighting a growing demand and a widespread misunderstanding of the role of consumer demand as a drivers of forest crime. The next chapter will examine the perspectives of people in both urban and rural areas who have a different relationship to forest crime, not as consumers but as potential perpetrators or influencers.